Diary of a Struggling Trader #3: Top 5 Investment Trends For 2022

Interesting themes to follow and be able to position early

(Not financial advice)

Disclaimer: Certain topics are highly oversimplified and may require previous understanding of underlying concepts by the reader.

Introduction

Hi fellow anons and welcome back to another post. If you are a recurrent reader, thank you so much for your support. If you are a new one, I hope you enjoy what you can find here. I am just sharing my journey and thoughts, trying to help as much people as I can while I keep growing. If you find anything useful in this article or enjoy any other pieces that I put out, please feel free to share it and subscribe, it really means a lot to me.

The crypto space can be such a chaotic place, even for people that have been on it for some time. Innovation happens constantly and simultaneously in a wide variety of sectors, so it is difficult for an anon to follow every trend and profit from it. Today, I want to go over 5 investment trends that I believe will be extremely powerful during next year. These are not going to be related to specific tokens, but more of broad concepts that could gain (even more) traction during the year and may provide a great opportunity to position. As I have explained in other articles, one of the most expensive mistakes for new entrants in the crypto space might be not following the current hot narrative, as you might miss on the best play of the moment while simultaneously be left bagholding some bags that will never return to ATH. Being aware of potential upcoming themes might be an interesting weapon for rotators but also for investors that can see potential long term. S/O Su Zhu and his recurrent mention of Amara's Law.

Context

Being familiar with the current market environment and situation of the industry will also be crucial information and add significant value to the investment thesis. During 2021, we have clearly seen the space take one step more towards mass adoption with retail getting more involved and institutions starting to acknowledge its potential. The recovery after the pandemic and especially the loose monetary policy of the Federal Reserve have been extremely beneficial for the industry, enabling an immense amount of inflows that have enhanced innovation. Of course, terrible projects and scams have exploded too and these are the ones that we should focus on exposing, as they undermine the reputation of the space and will make future regulations much more restrictive.

The launch of Bitcoin ETFs and the adoption of Bitcoin as a legal tender in El Salvador, have been two of the main events regarding institutional adoption. Paying attention to the subscriptions to the Bitcoin bond in this country might be a wise thing to do, as it could be a thermometer to measure the real interest that institutions have in the digital asset. This is because most of these large organizations currently do not have exposure or access to acquire spot BTC, and this could provide them an opportunity to start incorporating it into their balance sheet.

Why would they do that?

Because there is a clear situation of game theory behind its adoption and its programmed scarcity. Players that currently acquire more BTC could be significantly better off than their competitors in the future. Therefore, purchasing now a small amount of it could act as a potential hedge in case of an increase in the adoption level in the future, because if that happened, the acquisition cost would skyrocket. Even if there is a slight probability of this happening, the risks of not getting involved would mean a clear disadvantage against other countries/institutions. Even if just a small number of players bought into this thesis, the price of the asset could rise exponentially, as there is a large percentage of the supply that is illiquid and long term holders have an understanding of this game theory. The scarcity trade will play sooner than later and the risk/reward is clearly asymmetric.

Read about this argument on the Average Joe's Crypto Substack and would definitely recommend to check it out. Got a lot of knowledge and ideas from it.

In terms of other events getting us closer to mass adoption, we could mention a few:

Blockchains, protocols and decentralized applications now having real usability and providing value. Creating huge incentives for early adopters and therefore stimulating its use.

Fund raising in the industry is the easiest than it has ever been, especially if the word Metaverse is mentioned. This shows that a reasonable part of the liquidity flowing into the market in the last two years will be deployed in the crypto space, trying to foster innovation.

Large companies allocating capital to understand/build in the space: Facebook, Nike, KPMG, Visa, Adidas and many more. Of course we should mention MicroStrategy and Square.

Crypto exchanges and companies getting exponential exposure. FTX renaming the Miami Heat's stadium for example.

It is fair to think that these types of events will keep coming during the year and being positioned to profit from these trends is crucial.

1st thesis: Alternative layer 1 chains

One of the most obvious themes for the upcoming year will probably continue to be the rotation between alternative layer 1 chains, which has been one of the most popular and profitable trades in the crypto space during last cycle. For those that are not familiar with the concepts, it consists in buying blockchains that enable the deployment of smart contracts and that are different from Ethereum, which is the leader of this sector.

Regarding reasons for this theme to perpetuate, I would mention the following ones:

In Web3, the value accrual is much more concentrated on the protocol layer than on the application layer. This is due to the shared data layer and the potential value of native tokens, we will focus on the second one. Let's look at it this in a simple way. When a decentralized application (dapp) is deployed on a blockchain, it is indirectly promoting the use of the token of the native chain for transactions and interactions with its own token. If this dapp starts being successful it will attract more users, increasing the demand of its own token and therefore the demand of the chain's native token. This increase in interest will bring other developers to the chain, which will start building new projects if they enjoy the ecosystem, attributing even more value to the chain native token. As these units are usually programmed to be scarce, all of these interactions and the future potential ones will keep rising the price. This will increase the market cap of the protocol, while the dapp will only benefit from purchases and interactions with its own coin. If you think about it, buying the protocol layer (L1) is an option to invest in the different applications built on top of it with a minimized risk, but of course, less potential return.

More about it here: https://www.usv.com/writing/2016/08/fat-protocols/

Secondly, there is virtually a non-existent probability of a single chain dominating most of the transactions in the space. Each blockchain has its own consensus mechanisms, block time, block size and many other unique characteristics that enable them to work in a singular way. Bitcoin uses Proof of Work, Ethereum is transitioning towards Proof of Stake and Solana uses Proof of History. Therefore, each of them has a different approach regarding the trilemma: different level of decentralization, security and scalability. One of the main arguments behind the rise of alt L1s is that in the future of Web3, every transaction is going to be unique and specific, consequently requiring different security, speed or decentralization levels. In addition to that, users may have singular priorities and preferences. A small high-frequency transaction carried out on the blockchain may not require the same security level as the transfer of wealth between two individuals, but it may require a higher speed in the transactions per second of the blockchain. Taking as an example the recent Wormhole exploit, we should be able to understand that not the same security level should be required for every transaction, and this is a crucial aspect for this thesis to materialize in the future.

Lastly, one of the most compelling reasons behind this trend is simply the profit maximization aim of investors and traders. New layer 1s provide actual usability and efficiency, in contrast with projects that were launched in the past and lacked real world applications. Blockchain is still in its early stages of tech and a huge amount of innovation keeps happening on the space on a daily basis. Thousands of new applications in different areas are launched every day, providing value to the protocols in which they are built on, but most importantly, giving users opportunities to profit immensely from being early. These new chains offer spaces for new ecosystems to develop, new DeFi applications and other types of dapps that offer a large reward for early adopters. Arguably, the number one priority of a current blockchain user is not the tech, but the desire and capacity to create relevant wealth in a short time span. Therefore, there is an incentive for players in the space to focus their attention on alternative protocols that could reach higher token prices if they start getting traction, rather than focusing on current popular ones with limited upside. Players will focus their attention and money flows wherever they perceive that the upside is higher.

This argument leads to the next point, which might be controversial: there is no real reason why a new user would purchase ETH or start using the Ethereum blockchain. There is simply no motivation behind it, as it currently does not provide the best opportunity to create the highest possible amount of wealth. The congestion in transactions that the blockchain has experienced during the recent year has created large entry barriers for new users coming into the space.

These players do no have as much capital as it is required to move freely in the Ethereum ecosystem without considering the cost of fees, as they are just too high in comparison with other chains. In response to this, developers are moving to other protocols in which they could attract users much easier. The logic behind it is simple: for an application to strive, it needs to build a community and to attract users to a community, entry barriers need to be low.

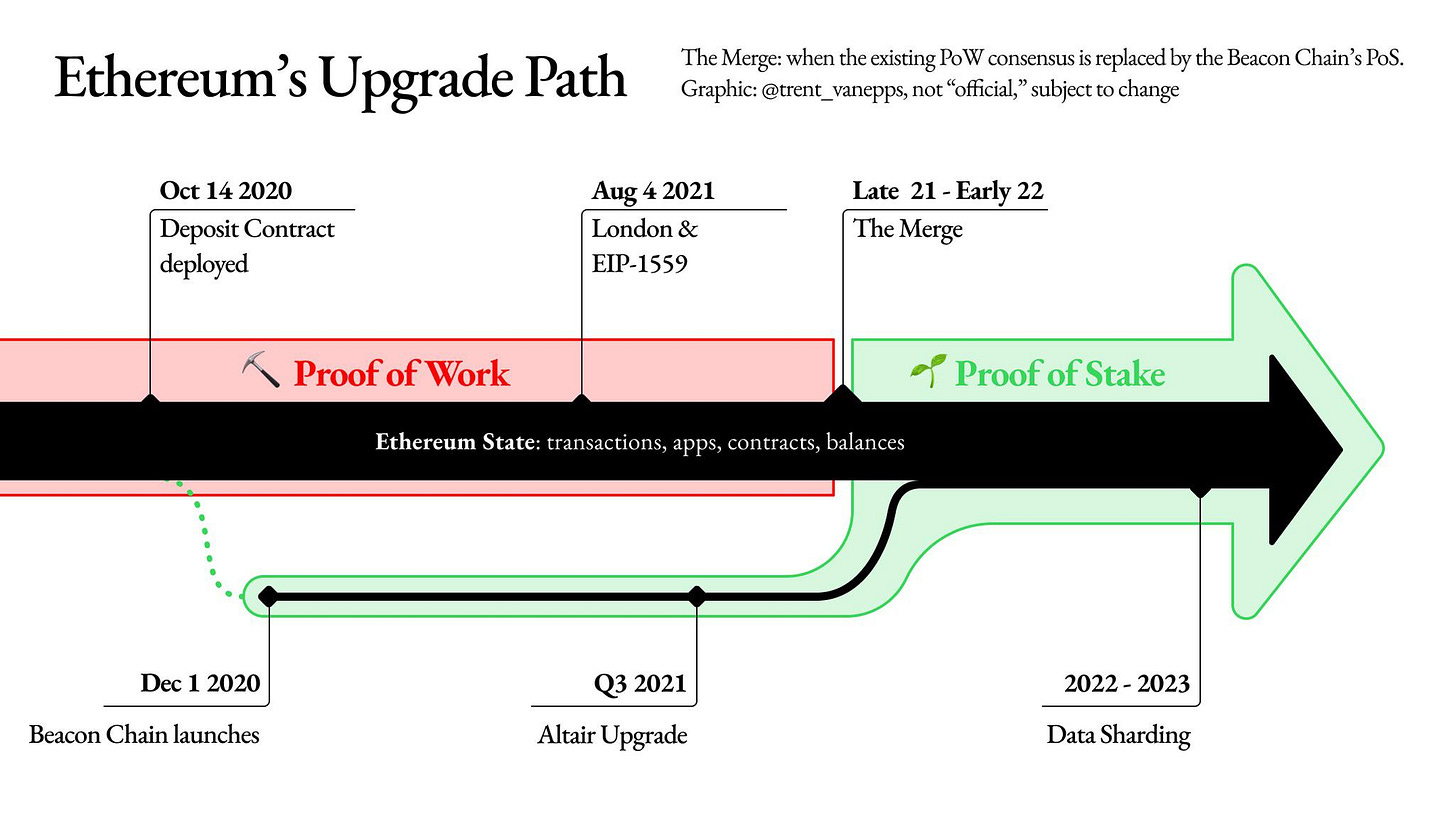

It is true that the Ethereum blockchain will transition during this year from Proof of Work towards Proof of Stake, but this will not reduce the congestion in the blockchain to the point that gas fee cost diminishes significantly. It will just change the consensus mechanism, in which now fees from transactions in the chain will be earned by validators and not miners. The update that could change considerably this could be the introduction of sharding, which is expected to be introduced sometime in 2023. While this might actually be highly beneficial for the chain and reduce gas fees considerably, by the time that it comes it may be too late. Other chains may have built strong enough network effects to at least take a share of Ethereum users, which later may be reluctant to abandon alternative chains completely just to get back in Ethereum. It is true that historically most of DeFi innovation has happened on this ecosystem, but this is by no means certain to continue happening in the future as talented developers are currently migrating to other protocols in order to attract users and bootstrap capital.

One argument that could be mentioned against it is that with the incorporation of EIP 1559 + The Merge + Sharding, there could actually be a bull case for ETH. Deflationary pressure due to token burning, jointly with an increase in the number of transactions on the blockchain due to lower fees, could make the coin increase in value considerably. However, new users, VCs and other capital allocators would not be incentivized to buy ETH, as its upside would still be much more limited than other chains in which they could potentially be early.

2nd thesis: Rising volume of Stablecoins

The second one of the trends that I would expect to thrive during 2022 would be stablecoins. The adoption of stablecoins and its increased use by retail and institutions is an obvious trend for the near future. Yield farming through these tokens will be a much more common technique for new entrants than yield farming through native application or protocol tokens.

This is because stablecoins represent the perfect asset for new entrants looking to get exposure to the crypto space while taking limited risk in their investments. They serve as the reserve crypto asset due to their stability, which comes from the peg to a fiat currency, crypto collateral or algorithmic system. As they are crypto tokens, they facilitate and enable much faster transactions and payments, while providing trading facility as they are already on chain. This constitutes a huge difference in comparison with fiat currencies. The concept of a representation of a fiat currency in blockchain is easy to grasp for new entrants and the risks perceived are virtually inexistent (although this may not be completely true).

The Chair of the Federal Reserve of the United States recently stated that the co-existence of stablecoins and central bank issued fiat currencies is totally viable, therefore it seems that regulations involving these tokens could become less uncertain this year. This would significantly increase its volume and usage, as one of the main reasons why crypto adoption has not happened yet is the lack of regulation and safety/certainty frames for investors and institutions. These players deploy large amounts of capital in assets when they allocate their resources and they need to act in an environment that provides at least a minimum degree of predictability and certainty.

Another argument to support its increasing use is the yield seeking needs of institutions, which are forced to deploy their capital somewhere in which they are able to avoid the loss of value of currency caused by the rising inflation. This issue is a result of the dovish monetary policy implemented by central banks as a response to the potential economic crisis after the pandemic. As you may have heard, inflation reported numbers are the highest they have been in years, and they probably are higher in real terms, as indexes do not measure every aspect involving the cost of living. In order to maintain the value of their assets or increase it, institutions look for places in which to deploy capital to protect themselves against this problem. Usually, a small part of their portfolio may be allocated to riskier assets with a higher beta that offer a higher potential return, but the conservative profile of these players leads to a much higher allocation to fixed income securities. Due to bonds offering such a low yield, considerably lower than the inflation expectations, institutions could be willing to look for new assets with a similar profile. Despite the fact that bond yields are expected to rise, they would probably not be enough to protect from the advancing inflation.

This is where stablecoins come in. The yield farming opportunities available through this asset in the crypto space are numerous, mainly based on liquidity providing, and yields are notably above the ones offered by securities in the traditional markets. It is clear that these tokens do not offer the same risk profile as fixed income securities because institutions would have to analyze and quantify new factors such as smart contract risk and potential legal issues. But these could actually be understood and evolve considerably in the future, sufficiently enough to attract inflows. The capital allocation to this recent asset class would be expected to be tiny, but if just a small fraction of the funds in the global bond market was deployed in the crypto space, such a large amount of capital could exponentially increase the level of innovation and growth of the industry. A man can dream...

As a final mention, it should be considered that this trend could be a double-edged sword for current users. While the net effect in the crypto space should be positive in the long term, the yields and opportunities would start decreasing as soon as large capital inflows start coming in. Nevertheless, due to the high level of innovation new protocols and strategies could arise to bring opportunities for capital allocators.

List of places to farm stablecoins. Credits to: @degenomix

3rd thesis: GameFi & Play to Earn (P2E)

The third trend that I will pay close attention will be the development of projects in the gaming sector, especially the ones involving DeFi and a Play-to-Earn concept. Historically, videogames have had an outstanding capacity to attract new players and maintain their attention. With the recent popularization of Fornite and other MMORPG videogames, the concept of in-game purchases has gained much more importance, revealing the desire of players to spend funds in the game and providing very relevant revenues to the companies implementing it into their projects.

The thesis for the crypto space is pretty simple. If developers are able to create a game that is fun to play for users, while being able to provide them a valuable income source, it could have an exponential capacity of onboarding new users into the crypto space. This would mean the alignment of incentives for players, which would be able to enjoy playing the game and interacting with other users, while also taking advantage of the hours spent playing by earning money. P2E games allow the user to earn rewards in the form of the native token of the protocol as a result of the time spent or the skill of the player. This would be the ultimate motivation to engage players, allowing them to create a new revenue source.

This gamification of the blockchain has a wide range of potential implications. Analyzing recent examples, we can appreciate the outstanding success of P2E games with Axie Infinity and DeFi Kingdoms. Both of them have in common the creation of an in-game ecosystem in which players are rewarded with the native token of the application for their interactions and skills. However, the last one implemented a new variation to it. This is based on a much more DeFi approach, in which players are able to exchange their tokens on the marketplace of the game, provide liquidity with the native coin and earn fees from the transactions, and use other blockchains' tokens to provide liquidity as a pair too. This opens a new world of possibilities for players to attribute utility to the token and a new incentive to earn more. In addition to that, the game implements the use of NFTs as items and collectibles, with the possibility of upgrading and trading them to earn a profit. This provides even more options for users, which are able to access a new level of profit maximization while enjoying the game. The changes and improvements implemented by DeFi Kingdoms are already being incorporated in several other games, which will provide gaming possibilities in other chains, expanding the scope of the trend.

Something worth mentioning is that blockchain games have a high potential to enhance crypto adoption. If a game successfully engaged with the young market segment, it could make users flow towards other sectors of the space and become crypto natives with the pass of the years. The same could be applied whatever the blockchain in which these applications are developed, as users could easily flow towards other dapps, providing significant value to the chain too.

Nevertheless, it is fair to mention that most of the P2E games developed during recent months have reached levels of exaggerated overvaluation. With just a fraction of the users that other traditional videogames have, they have reached incredibly high fully diluted valuations, and most of them have token unlocks coming during the following years, what could be extremely detrimental for its price. The expected growth is severely priced in, as well as the hype around the Metaverse, which has been a popular trend during recent months. From my perspective, the market has still not realized the huge difficulty that these platforms face in order to maintain users and create sustainable economies. If most of the rewards and benefits of the game are given to the early users, there is a lack of incentive for new players to get into the ecosystem. Moreover, once the early users have exploited the advantages provided, they will look for alternative applications that provide better returns instead of playing the same game. This thesis is effective as far as the following argument is true; current players are mostly profit maximizers, as current blockchain games do not provide the same entertainment level as traditional games. Of course, this something arguable depending on the player, but seems to be the consensus between the crypto users. Once an entertaining game becomes popular and is able to engage users for the long term, it could rapidly become a game changer and lead to recurrent profits.

Inspiration and ideas from Ansem´s Substack.

4th thesis: NFTs with utility

In my opinion, the fourth trend that would be worth paying attention to would be the popularization of different types of applications for NFTs, giving them a new sense of utility. The characteristics of non-fungibility and immutability of these tokens have led to its massive use as digital art representations. During last year, thousands of collections were launched, some of them reaching unseen levels of hype and market valuations. Profile picture collections such as Crypto Punks or Bored Ape Yacht Club gained insane levels of popularity, making the news and attracting the attention of individuals outside that space that wanted to get involved with it. NFTs constitute unique pieces to which users in the space are able to attach value, as they are non-divisible, non-replicable and easily identifiable through the on-chain data. Nevertheless, the properties of this type of asset enable us to make them usable in several other ways. The value proposition is still focused on their scarcity and collectability, but the inherent utility will be different.

Several utility possibilities for NFTs:

Staking/farming in a protocol to earn yield. This consists in providing the NFTs owned by a user to a protocol in which it is able to be used as collateral, or any other option that can make it liquid. While this would not change the main purpose of the token, as it could still be a part of an art collection for example, it would provide the collector a new income source from which to profit, while still enjoying the benefits of possessing the asset. Very useful to long term holders that want to leverage their positions or make them more liquid.

Use of NFTs as a substitution for fungible tokens to improve capital efficiency of locked tokens. One example of this can be observed in the proposed tokenomics of Solidly, also known as ve(3,3), the project created by Andre Cronje in the Fantom ecosystem. In this project, which aims to be an automated market maker for business-to-business commerce (B2B), similar tokenomics to the Curve protocol ones will be implemented, in which holders are able to stake their coins to obtain revenue from the trading fees in the platform. The longer users stake their tokens, the higher potential reward. However, instead of providing fungible ve-tokens, these positions will be represented by NFTs, enabling them to represent unique positions and be traded in secondary markets or used as collaterals. This type of use could be applied to many other applications with locking mechanisms and will sure have many more variations in the future.

Creation of social tokens with specific and unique characteristics, entitling the owner to special privileges or access. This type of use could gain relevancy, as it would enable communities as well as creators to provide ownership to members, offering different kinds of privileges depending on the type of token owned. While these could also be distributed as fungible tokens, the use of NFTs could provide a wider range of possibilities to the distributor in order to differentiate within the members and holders. This could be an incentive to attract new individuals interested in specific rights or benefits and would enable other users currently not in the community to invest in the potential success of these organizations. Could have noticeable traction if it started being used by influencers or celebrities, and it is something to pay attention to, as it could be highly profitable.

Ownership and fractionalization of real-life assets. NFTs could become a representation of ownership of assets in the real world, from real estate to collectible items, potentially including stocks and other financial assets. This is because their immutability and ease of verification characteristics could be a very useful tool against counterfeits, and they could also make distribution and ownership much easier through the fractionalization of assets that otherwise would have to be traded as a unit. Splitting the ownership of an asset in smaller fractions could make it much more affordable for the average user, increasing its degree of liquidity and potentially its value.

Those are some of the ways in which I could imagine NFTs being used in the future, aside from its usual utility as digital art representation. However, these are just examples. There is an endless number of possibilities to be discovered, as not even a fraction of its potential is unlocked yet. New utilities for NFTs will be conceived and they are worth paying attention to.

Me writing this.

5th thesis: Modularity

The last trend that I would expect to thrive during the year would be the rise of modular blockchains. In an attempt to oversimplify the explanation, a classic monolithic blockchain has three basic tasks: execution, security through consensus and data availability, and tries to accomplish these three in the same space. This leads to certain limitations, inefficiencies and the appearance of the infamous trilemma, having to sacrifice at least one of the crucial aspects of a blockchain: scalability, security and decentralization. Modular systems divide all different layers that form the usual blockchain into separate chains to enable the specialization of functions. This would mean that each layer carries out a specific function to avoid congestions and enhance effectivity.

One of the main blockchains working in this direction is Ethereum, which is currently developing a modular design architecture. This will be carried out through the implementation of different methods in each layer to improve its functioning.

The execution task will be carried out through layer 2 applications. These are basically smart contracts that bundle transactions from the main chain into a single transaction. The execution of these transactions happens outside the main chain, to then settle and post the data back on the main chain. What this does is avoid part of the congestion caused when executing everything on the protocol, reducing gas fees and increasing the speed of the blockchain. As rollups do not have to care about consensus and data availability, they specialize in the execution of transactions effectively. Regarding the security and the consensus method, it will be done through the implementation of Proof of Stake, which will enable validators to carry out their function while avoiding extensive hardware requirements, which is the case of Proof of Work systems. In terms of the data availability, it will be upgraded through the introduction of sharding, which is a partitioning technique based on "splitting a database horizontally to spread the load". By decentralizing Ethereum in several different data availability layers, it will be able to scale more securely.

Despite certain monolithic blockchains trying to implement these new characteristics into their design, there are several other protocols working on this concept from its inception. Projects such as Celestia are focusing on building a layer of this modular blockchain architecture, in this case based on data availability. Other applications are focused on the execution layer, providing great scalability solutions to blockchains. Many others will arise in the future, providing blockchains different options to take a step towards modularity and avoid the inefficiencies that happen due to the concentration of tasks. While Ethereum keeps working on these upgrades, these applications and protocols have an opportunity to build valuable network effects that enable them to acquire and maintain new users. Also, this could provide a new thesis in the crypto space towards the value distribution in the different layers of the blockchain, and not only on the L1.

If crypto adoption is about to become a reality in the near future, modularity might be one of the best approaches to blockchain building. While most alternative layer 1s currently require users low transaction fees when transacting in the network, the situation could rapidly change with a massive onboarding of new entrants in the blockchain. There is a limit in the amount of transactions per second that the nodes of these chains will be able to validate, therefore they will get congested and stop functioning until its solved. Modular chains could become a very powerful strategy to solve the trilemma currently faced by layer 1s, enabling more security, scalability and decentralization while avoiding potential inefficiencies that could arise.

Final Note

The purpose of this article is to compile some of the most interesting trends that I currently see and that could have endless legs in the future. This gives me the opportunity to go back and reevaluate my thesis in the future, to see which arguments were valid and which ones were not. In addition to that, it is also a useful piece to help others to become aware of new trends in the crypto space, or at least be encouraged to do some more research.

To me, it is a win/win situation, therefore I decided to write it. I am open to debate any of the arguments proposed and I would love to learn more about any of the topics.

If you enjoyed the article, please feel free to share and subscribe. Also, I am open to suggestions about potential topics for new pieces, as I would like to challenge myself a bit more. Thank you for the attention and see you on the next one!

ETH wallet if somebody is trying to help a hungry student: 0xa9e329b3FF760E3f3011dE599E47A8B0F2099CD4

Good one

Really enjoyed this bro. keep up the good work trying to become an analyst as well so feel free to dm me ever